How Many Poeple In The Us Use Financial Services

Few innovations in the financial world have been as revolutionarily user-friendly as online banking. What typically entails waiting in long lines now can be washed from the comfort of your home. So, information technology's no surprise that online banking is now a vast part of the banking industry.

We've put together some of the about interesting online cyberbanking statistics to evidence y'all just how much the service has grown since the 1990s.

The stats embrace topics ranging from the industry'southward market value to the latest mobile banking trends. You tin can also discover other fascinating insights, such as adoption rates and information protection.

Essential Internet Cyberbanking Statistics (Editor's Choice)

- The boilerplate American banking company user has around five banking concern accounts

- In 2020, the global marketplace size for wearable payment devices reached $10.35 billion

- Banking Trojans attacked 625,364 PC users in 2020

- At least once a month, 73% of people globally employ online cyberbanking

- 38.4% of smartphone users make in-store payments at least twice a year

- By 2023, more than 80 one thousand thousand people will use neobanks in Europe

Online Banking Statistics

one. The average bank user in the US has v.3 banking company accounts.

(PaymentsJournal)

People tend to choose different banks for the various benefits of their services, resulting in more than a single bank account per person. According to the online banking usage statistics from 2019, the boilerplate client has over v accounts across all types of fiscal establishments.

Among the reasons for opening an account in a specific bank, 49% of people say it'south due to feeling comfortable in that location, 26% already have an issued card from that establishment, and it's where 14% keep their investments.

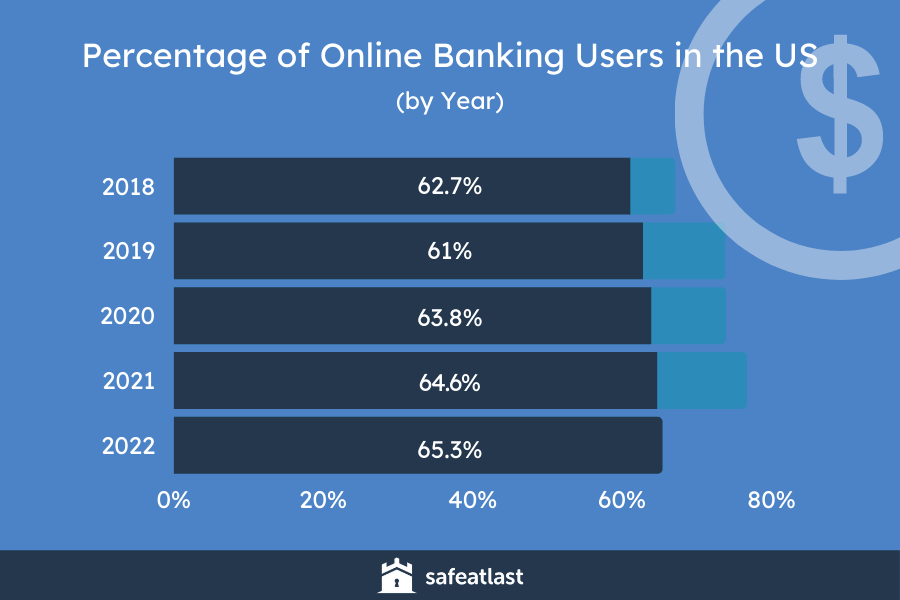

2. In 2021, 64.half-dozen% of U.s. citizens used online cyberbanking.

(Statista)

Online banking statistics bear witness more and more people in the The states are embracing digital banking.

While in 2018, 61% of people used digital banking, in 2020, the number grew to 63.8%. Estimations evidence that by 2022, the share will probably rise to 65.3%.

3. The volume of digital payments in the beginning one-half of 2020 increased by 21%.

(Sijoitusrahastot)

Online banking statistics from 2020 bear witness digital payments got a significant volume bump in 2020. Digital banking's transaction volume also grew by 10%.

4. The global market size for wearable payment devices was $10.35 billion in 2020.

(Grand View Research)

Some of the wearable tech pieces tin be used as payment tools. Such devices turned out to be one of the biggest trends in mobile cyberbanking.

Experts predict the marketplace value of vesture payment tech to grow at a compound annual rate of 29.viii% between 2021 and 2028.

five. 625,364 PC users were attacked with cyberbanking Trojans in 2020.

(Kaspersky)

That represented a decrease from the 773,943 attacked users in 2019. Online banking facts and stats reveal that the most frequent victims of this fiscal malware in 2020 were Germany, Russia, and Kazakhstan users.

In particular, around 22% of the users were attacked by Zbot, the most common banking malware. Moreover, CliptoShuffler attacked near xv%, and Emotet — approximately 14% of the PC users.

Online Banking vs. Traditional Banking Statistics

6. lxxx% of people adopt online cyberbanking over visiting a brick-and-mortar establishment.

(Consumer Diplomacy)

The online banking usage statistics from 2020 show usa that merely twenty% of U.s.a. citizens are more inclined to visit a depository financial institution in person than apply their smartphone or calculator.

7. 95% are confident that the bank can protect their data.

(Consumer Affairs)

According to the digital cyberbanking statistics from 2019, most people are positive that banks can protect their data. The statistics as well show that 66% of people feel satisfied with their depository financial institution and its digital services.

viii. Only 12% of people older than 54 use mobile payment services.

(Consumer Affairs)

The mobile payment usage statistics testify that thirty% of people use mobile payment services at least once a week. However, approximately 12% of people over the age of 54 do the aforementioned.

9. 56% of people accept been redirected to the physical establishment while doing their banking online.

(Lightico)

The COVID-19 pandemic made a lot of people experience wary nigh visiting physical bank locations. Merely, unfortunately, over half of the U.s. internet banking users couldn't solve their bug without going in that location.

Another 48% share they had to print, sign, and email bank-related papers when using the online banking services.

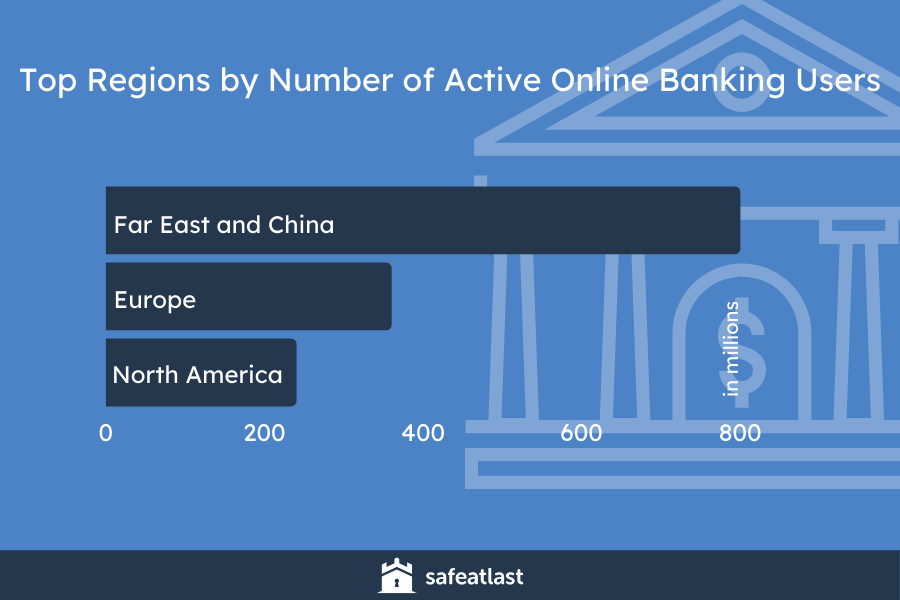

10. Far Eastward and Prc represented more than 800 million active online banking users in 2020.

(Statista)

So, they deemed for the largest part of the users. Europe came second, with around 360 million active online blistering users, and North America took the third identify, with about 240 1000000 users.

In 2020, nigh 2 billion people globally actively used online banking, This trend is projected to rising. In fact, by 2024, there volition probably exist ii.iv billion people who actively apply online banking. Moreover, 2020–2024, the Asian marketplace is forecasted to reach almost a billion.

Mobile Banking vs. Online Banking Statistics

11. 76% of US survey respondents use a mobile banking app.

(Forbes)

On the other hand, a fifth of the respondents claim they don't employ an app for cyberbanking. When asked about the reason why, the ones that use the mobile banking apps mentioned several things.

For instance, around 35% of respondents claim mobile check deposit is the feature they find well-nigh useful. About 33% similar the feature of viewing statements and business relationship balances. Another feature mentioned by the respondents (31%) is transferring funds between accounts.

12. 73% of people worldwide use online banking at least once per month.

(Deloitte)

According to mobile cyberbanking statistics, money transfers and balance inquiries are ii of the most common uses for mobile banking apps.

On the other hand, 59% of people find the online banking method more than secure for complicated processes. That means inquiring about products, transferring money internationally, or updating business relationship information.

thirteen. 62% of consumers have a better sensation of their financial situation thanks to mobile cyberbanking.

(Statista)

Compared to visiting an actual bank, online banking is the quicker and simpler selection.

The new mobile banking trends testify people have an increased sensation of their fiscal situation. Over sixty% of consumers said they've become improve at keeping tabs on their accounts due to this service.

14. Equally of June 2021, Nubank reached the 25-meg-user benchmark.

(Statista)

Nubank is one of the leading app-based virtual banking companies in the world. It has an impressive number of users worldwide.

Comparing its figures with global online banking statistics makes Nubank's foothold apparent. On the other manus, Revolut (Great britain) and Chime (US), two other major companies, provide for 13 and eight million consumers, respectively.

15. 38.4% of smartphone users make an in-store mobile payment at to the lowest degree once every 6 months.

(Emarketer)

Mobile payment statistics guess over a third of all smartphone users in 2020 fabricated at least i in-store payment using a mobile app every six months.

The projected use for the 2021-2022 period increased from 39.9% to 41.1% of the people and information technology will grow from 41.one% to 42.2% between 2022 and 2023.

The majority of adoption comes from the Asia-Pacific region, mainly in China.

Latest Trends in Mobile Banking

xvi. The deployment of chatbots will save the cyberbanking manufacture $seven.three billion by 2023.

(Juniper Inquiry)

Chatbots are i of the biggest trends in mobile banking. They save companies tons of coin every bit they replace paid staff and due to their abiding availability.

Juniper Inquiry has significantly raised its initial prediction of $209 meg saved on client service.

17. There will be over 85 million neobank users in Europe past 2023.

(Kearney)

A neobank is a bank that offers only digital services. This concept comes with many perks that have thus far contributed to the online banking growth we see today.

The lack of overhead costs results in lower fees for customers. The users tin can manage their banking obligations with just a few clicks instead of visiting a bank in person.

Stats on online banking trends show that the number of neobanks has grown to over 15 million since 2011. In add-on, the number of neobank customers in Europe is expected to achieve 85 million by 2023.

18. Mobile browsers and apps account for 71% of fraud transactions.

(Specialist Cyberbanking)

The presence of fraud transactions on cyberbanking apps and browsers is one of the more worrying mobile banking technology trends. The well-nigh recent research shows that the rate of such scams is on the rise.

Conclusion

The banking mural constantly shifts and adapts as new technological innovations enter the scene. This has always been the example, from credit cards to ATMs.

Online banking is non much dissimilar in that regard. The extent of the change it brought has been — and continues to be — profound.

All the above online cyberbanking statistics show positive industry growth and widespread adoption.

Nosotros tin't precisely predict whether this service will make traditional brick-and-mortar banks obsolete. At current rates, however, it most certainly is turning into the default cyberbanking option worldwide.

People Likewise Ask

How has electronic cyberbanking changed cyberbanking services?

Electronic banking has a profound impact and continues to change the financial landscape. For i, information technology allows people to do their cyberbanking with just a few clicks of a button.

That makes financial diplomacy both quicker and more convenient, especially in the COVID-nineteen pandemic settings.

Banks that implement online capabilities tend to have lower fees due to the lack of overhead costs.

When did online banking start?

While at that place were similar concepts as far back equally the 1980s, the first online bank became available to the public in 1995. At that time, nonetheless, only a tiny fraction of people were online.

The Security Starting time Network Bank opened on October eighteen, 1995. It was the starting time bank to offer many of the features nosotros associate with online cyberbanking today. In the years to follow, numerous online banks took cues from SFNB'south structure and innovations.

Are banking apps secure?

Generally, mobile apps are secure for your fiscal needs. In fact, mobile apps tend to be safer than online banking in some respects. Mobile devices take additional hardware security features that make mobile banking a more than secure process than cyberbanking online.

How many people bank online?

Co-ordinate to online cyberbanking statistics, over 160 million people in the U.s. use online banking regularly. However, experts have predicted this number volition rising past 2022 — effectually 65% of the US population will exist using digital banking.

Even more than people are using online banking tools occasionally. Namely, around 73% of people with bank accounts utilise online banking at least in one case a month.

How Many Poeple In The Us Use Financial Services,

Source: https://safeatlast.co/blog/online-banking-statistics/

Posted by: graysonausand.blogspot.com

0 Response to "How Many Poeple In The Us Use Financial Services"

Post a Comment